Remain Updated with Market Patterns on a Leading Forex Trading Forum

Remain Updated with Market Patterns on a Leading Forex Trading Forum

Blog Article

The Value of Currency Exchange in Global Profession and Business

Currency exchange serves as the foundation of global trade and commerce, enabling smooth transactions between varied economies. As fluctuations in exchange rates can posture substantial dangers, efficient money threat management becomes extremely important for preserving a competitive side.

Function of Currency Exchange

Money exchange plays an important duty in facilitating worldwide trade by making it possible for purchases in between parties operating in various money. As organizations increasingly take part in international markets, the need for efficient currency exchange systems becomes paramount. Exchange prices, which vary based upon various economic indicators, identify the value of one money family member to an additional, affecting trade dynamics substantially.

Additionally, money exchange alleviates dangers linked with international transactions by offering hedging options that safeguard against negative currency activities. This monetary tool permits companies to support their costs and revenues, better advertising global profession. In summary, the duty of currency exchange is main to the functioning of global business, providing the crucial structure for cross-border deals and sustaining economic growth worldwide.

Effect On Prices Methods

The systems of currency exchange considerably influence pricing methods for organizations involved in worldwide profession. forex trading forum. Variations in currency exchange rate can lead to variants in prices related to importing and exporting items, engaging business to adjust their prices models as necessary. When a residential money strengthens against international money, imported items may end up being much less expensive, allowing companies to lower rates or increase market competitiveness. Alternatively, a weakened residential money can blow up import expenses, triggering companies to reassess their pricing to preserve profit margins.

Companies often take on prices methods such as localization, where costs are tailored to each market based on currency variations and neighborhood economic factors. In addition, dynamic prices models might be used to react to real-time currency motions, ensuring that organizations stay nimble and competitive.

Impact on Revenue Margins

Changing exchange rates can greatly affect revenue margins for services involved in global trade. When a business exports goods, the profits generated is often in a foreign currency. If the value of that money lowers relative to the firm's home currency, the earnings understood from sales can lessen dramatically. Conversely, if the foreign currency appreciates, earnings margins can increase, boosting the total economic performance of the company.

In addition, organizations importing items face comparable dangers. A decline in the value of their home currency can lead to higher prices for international goods, ultimately squeezing profit margins. This situation necessitates efficient money threat administration techniques, such as hedging, to reduce potential losses.

Additionally, the effect of currency exchange rate fluctuations is not restricted to route purchases. It can also affect pricing approaches, competitive placing, and overall market dynamics. Firms should remain watchful in keeping an eye on currency patterns and adjusting their financial approaches appropriately to shield their bottom line. In recap, understanding and see managing the influence of money exchange on revenue margins is important for services striving to preserve productivity in the facility landscape of international profession.

Market Gain Access To and Competition

Navigating the complexities of worldwide trade requires services not only to manage earnings margins however likewise to make sure reliable market accessibility and boost competitiveness. Currency exchange plays an essential function in this context, as it straight affects a firm's ability to go into new markets and complete on a global scale.

A beneficial currency exchange rate can reduce the my company cost of exporting products, making products extra appealing to foreign customers. On the other hand, an unfavorable rate can inflate costs, preventing market penetration. Firms need to purposefully take care of currency fluctuations to optimize rates techniques and stay affordable against regional and international players.

Furthermore, organizations that successfully utilize currency exchange can produce possibilities for diversification in markets with favorable problems. By developing a solid visibility in multiple money, companies can minimize threats connected with reliance on a solitary market. forex trading forum. This multi-currency method not only enhances competition yet likewise promotes resilience despite economic shifts

Threats and Difficulties in Exchange

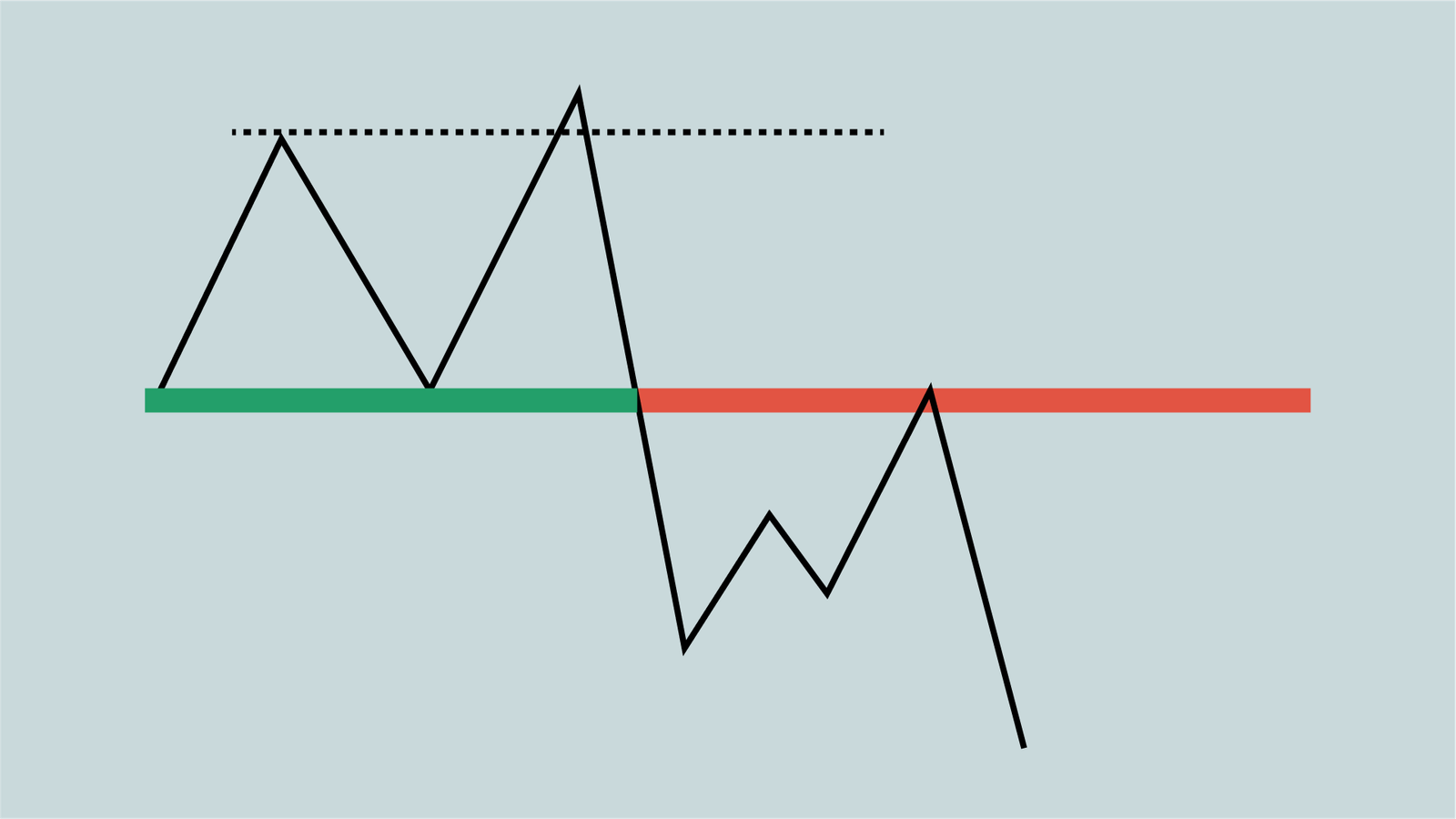

In the world of international trade, companies encounter considerable risks and difficulties connected with money exchange that can impact their monetary stability and operational techniques. One of the key risks is currency exchange rate volatility, which can result in unanticipated losses when converting currencies. Changes in exchange rates can influence earnings margins, particularly for firms engaged in import and export activities.

In addition, geopolitical variables, such as political instability and governing adjustments, can exacerbate money threats. These elements might result in abrupt shifts in currency values, complicating financial forecasting and preparation. Businesses have to navigate the intricacies of international exchange markets, which can be affected by macroeconomic indicators and market view.

Verdict

In conclusion, currency exchange offers as a keystone of international trade and commerce, assisting in purchases and improving market liquidity. Despite integral threats and challenges connected with fluctuating exchange rates, the value of money exchange in promoting financial development and durability stays indisputable.

Report this page